Intro:

The Winter of 1998, Economical Catastrophe and the Currency Board

The

last years of the past millennium proved very formative for Bulgaria. After the

ascension to power of a socialistic government lead by the premier, Jan

Videnov, in 1996 there are more than 15 banking collapses with the whole system

put at severe risk. The inflation is galloping with levels above 1 000 %1

in January 1997, whereas the exchange rate USDBGN approaches 3 000 BGN2

for a single dollar, compared to just above 70 one year ago.

What comes next is the most determined turn of Bulgaria towards the West and the European Union. The IMF and the World Bank provide financial mechanisms for stabilisation of the economy, whereas a technocratic government, appointed by the president of the republic, works together with a team of experts from these two institutions to implement a currency board so that price and exchange rate stability can be promoted. The Bulgarian lev is fixed to the German mark at a rate of DEMBGN 1; in the summer of 1997 after the adoption of the euro by Germany the, lev is fixed per se to the single currency at a rate of EURBGN 1.95583. A fixing that still holds more than 22 years later and is highly valued by the people and businesses in Bulgaria, this is the most successful case of currency board and fixed rate implementation in the worlds’ history.

2020: Entering the Euro

Moving forward in time, at the beginning of 2020 Bulgaria finds itself at the doorway of the Eurozone. What are the steps the country must take next to join the single currency, which should be the ultimate goal of each EU country?3

1. EBU

Membership: Bulgaria has already submitted its application to join the European

Banking Union. As a result, in 2019 a comprehensive assessment of six Bulgarian

banks conducted as asset quality review and stress tests, following the request

for close cooperation with the ECB, has been completed. Currently two of the

local banks are pending for capital increase, after which Bulgaria will be

eligible to join the Union, which is expected to happen simultaneously with

joining the ERM II.

2. ERM

II membership and financial stability criteria: in February 2020 Bulgaria has finished

the legal synchronization which will allow the country to enter the ERM II,

nicknamed “the waiting room” of the Eurozone. After official ascension in the

Mechanism, approved unanimously by all the financial ministers of the

Eurogroup, the country will stay minimum 2 years before adopting the Euro.

Besides assuring that the exchange rate can be kept stable (which in Bulgaria’s

case should not be a point of discussion), the period in EMR II provides for

economic stability, with attention paid to several convergence criteria, also

known as Maastricht criteria.

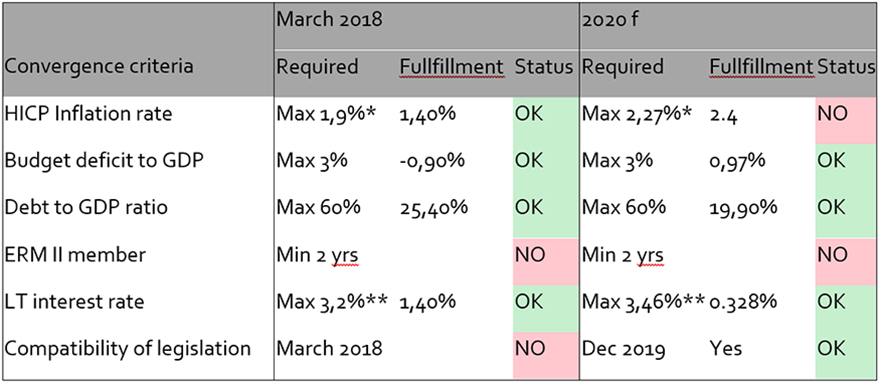

The convergence criteria itself are produced at least once in every two years and the last convergence report was released in March 2018. The development of these economic indicators and requirements presents a clear picture of what remains to be fixed:

*The rate of increase of the 12-month average

HICP over the prior 12-month average must be no more than 1.5% larger than the

unweighted arithmetic average of the similar HICP inflation rates in the 3 EU

member states with the lowest HICP inflation. The required HICP inflation for

2020 is based on our own estimate and it may differ from the forthcoming

convergence report.

**The arithmetic average of the annual yield of 10-year government bonds as of the end of the past 12 months must be no more than 2.0% larger than the unweighted arithmetic average of the bond yields in the 3 EU member states with the lowest HICP inflation. The required LT interest rate for 2020 is based on our own estimate and it may differ from the forthcoming convergence report.

The Near Future: Euro Accession and its Technicalities

There are two possible scenarios of the country to join the Euro zone, both taking care of how is the euro technically adopted4:

1. The

Madrid Scenario: agreed by the first countries that adopted the euro, this

scenario included fixing the exchange rates of the local currencies to the euro

in May 1998, official adoption of the euro on 01/01/1990, holding a three-year

transition period, during which euro banknotes and coins were not introduced,

introducing them on 01/01/2002 and having dual circulation for a couple more

months. This scenario is more time-consuming, but considered less stressful for

the adopting country.

2. The

Big Bang Scenario: this is the much simple scenario in which euro is adopted in

the country after the positive decision by the Eurogroup, then there is a dual

circulation period of up to 6 months, after which the local currency is

scrapped.

Taking into consideration the fact that the lev is pegged to the euro for more than two decades, and the fact that no stress-relieving transition is needed for Bulgaria, it is almost certain that the country will adopt the Big Bang Scenario during its euro implementation.

Looking Forward: What Can Be Expected after the Euro Implementation in Bulgaria

There are several competing theories about the presumed advantages and disadvantages of the euro. Spanning from loss of independency to significant improvements in trade and FDIs (foreign direct investment), some of them deserve a closer look.

Starting with the pros, there is a significant report by Richard Baldwin et al5. suggesting the two major areas which Eurozone accession bolsters – trade and FDI. The findings of the report suggest an improvement of trade of around 5 % and FDI improvement from both Eurozone and non-Eurozone countries in between 15 and 100%.

In terms of trade improvement, one cannot expect Bulgaria to meet the stated targets. First the major factors relating to trade improvement – having less currency risk and exchange rate volatility, have been in force for Bulgaria for the past two decades. Second, Bulgarian firms have had their chance, have and are competing on the same basis with their Eurozone counterparties due to the currency board.

The more interesting is the FDI effect. Although the board have brought to monetary stability, and the party that has been ruling the country more or less for the past 12 years is focused on fiscal stability, the foreign investments have been a difficult task to stably achieve for Bulgaria. It can be expected that, after entering the monetary union, the FDI will have a boost primarily coming from the closer integration of Bulgaria to the major European institutions, this time in the form of stricter monetary and supervisional authority from the ECB.

Further, there are benefits concerning the banking system in Bulgaria. First of all, once in the Eurozone, Bulgarian banks will be eligible for participation in TLTRO (targeted long-term refinancing operation) and other liquidity instruments, provided by the ECB. Currently, being part of a currency board curbs the Bulgarian National Bank’s ability to undertake such measures. Further, the banking sector is poised at benefitting from the tiering system for charging excessive liquidity with negative interest rates, which is currently unavailable to banks locally. Added to all this, the additional capital measures for systematic risks and capital buffers’ requirements will be lowered, which will result in a better and more effective banking system in Bulgaria. Having all this in mind, the banking sector can be considered as one of the most benefitting from Eurozone accession.

Moving to the cons side in a paper from 2013 Mursa6 outlines that the major disadvantages of joining the euro are related to losing or giving up monetary authority to the ECB and the bureaucrats in Brussels and Frankfurt-am-Main. Being in a currency board, there is no monetary authority resting with the Bulgarian National Bank (under the terms of the currency board, besides setting the main interest rate, which in theory cannot be different from the euro deposit facility due to the interest-rate parity and the possibilities for arbitrage that could arise for the Bulgarian banks which are entitled to buy and sell the EURBGN at the fixed rate). Moreover, the balanced fiscal stance has been the case for each government since the crisis of 1997. Take these two into consideration, it can be expected that Bulgaria will not be hurt from the loss of independence.

There are some additional cons, the major of which is concerning the inflation and the loss of value of the populations’ savings when the country moves for one currency to another. Based more on anecdotal evidence than on everything else, these have not materialized with any other Eurozone joining member, and we cannot expect them to have an effect on the Bulgarian economy. Further, Bulgaria would join a Eurozone that is more separated than before, having members such as Greece and Italy that have long flouted the requirements for budget deficits and government debt.

Looking from the perspective of the president, with the memories and experience that Bulgaria has as a post-communist country, it is clear that entering the Eurozone is the next important step that Bulgaria must and will make in following its European path. A step that will most probably lead to an overall economic improvement and more stability for people and corporations in the country.

1 National

Statistics Institute; https://infostat.nsi.bg/infostat/pages/reports/result.jsf?x_2=664

2 Bulgarian

National Bank; www.bnb.bg

3 European

Council; https://www.consilium.europa.eu/en/policies/joining-the-euro-area/convergence-criteria/

4 European

Commission; https://ec.europa.eu/info/business-economy-euro/euro-area/introducing-euro/scenarios-adopting-euro_en

5https://ec.europa.eu/economy_finance/publications/pages/publication12590_en.pdf

6http://ceswp.uaic.ro/articles/CESWP2014_VI3_MUR.pdf