Are you already using the new internetbank?

You can log in hereDo you want to use the new OTP MobilBank?

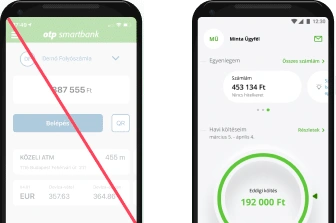

Download the new OTP MobilBank app and manage your finances on your mobile.

Details and downloadNew internetbank and mobilbank

Discover the new OTP InternetBank and MobilBank services and manage your daily finances on our new digital channels!

Register easily in the OTPdirekt internetbank, at the ‘New internetbank registration’ menu!

Show me the detailsAre you already using the new internetbank?

You can log in hereYou specified an incorrect ID or account number.Where did I make a mistake?

You specified an incorrect ID or account number. Upon login pay attention to the following:

- The ID consists of maximum 7 digits, and you find it on your OTPdirekt contract.

- The account number consists of 16 or 24 digits, and you find it on your OTPdirekt contract or account statement.

If you still cannot log in, visit one of our branches, where our staff will provide you with your login data and reset your password, if necessary!

SmartBank for retail customers have been phased out

From 24th March 2022 the SmartBank service for retail customers has been replaced with the new OTP MobilBank.

Frequently asked questions

What is OTPdirekt for?

Internet banking, call centre, SMS-based control and smart phone services: manage your finances in a comfortable and fast manner, no matter where you are, 24 hours a day and seven days a week via OTPdirekt! You can read more on the OTPdirekt services here.

Access to Internet bank

You can use the Internet bank only if you conclude a contract with us for this service. You can do so in any of our branches.

- If you already have a contract for OTPdirekt call centre services, you may also conclude the contract for the Internet bank by calling +36 (1/20/30/70) 3 666 666.

- If your bank account has several account holders, each account holder must conclude the contract separately.

- If the account holder is below the age of 18, s/he may only conclude the contract in person in any of our branches, in the presence of her/his legal representative.

- If you are a commercial banking customer, you can initiate the contract only in person in your home branch.

If you wish to access your securities account via the Internet bank as well, first you will have to adjust the settings:

- Select in the Internet bank the Settings / Maintenance of account range menu item

- Tick off the Account range box in the securities account row

- Click on the Modify button.

- Approve the order.

Should you have any problem while adjusting the settings, contact our staff for assistance:

- over the phone at +36 (1/20/30/70) 3 666 666, if you have an OTPdirekt call centre contract, or

- visit any of our branches.

If you are a commercial banking customer, please visit your home branch in person. In this case our staff can only help you with the settings in the branch.

Password

You will need your private password for logging in to the Internet bank for the first time.

- If you request the Internet bank access in one of our branches, you can specify your private password right there.

- If you request the access via the OTPdirekt call centre service, we will send you your private password in a PIN envelope.

The private password given by the bank is only valid for the first login. When you log in, you will be prompted to change your password immediately.

- The new password must be 6 to 8 characters long and contain numbers, lower and upper case letters.

- The password may only contain numbers and letters. Do not use other characters, e.g. ?, %, _, space.

- Do not use accented letters.

- Your new password must differ from your previous password at least in 3 characters.

You can request a new password in any of our branches. Please do not forget to change the new password upon the first login.

- If you are a commercial banking customer, you can request a new password only in person in your home branch.

- If you are a retail

customer, you stay permanently abroad and have forgotten your password, send us

an e-mail to informacio@otpbank.hu:

- Request a new password in your mail.

- In our response, we shall send you a declaration related to the issue of a new password.

- Have the declaration certified

by the Hungarian embassy and send it to the following address:

OTP Bank Plc

Digital Sales and Development Directorate

1876 Budapest - After having received the declaration, we will send the envelope containing the new password by post to the address specified by you. We will debit your account with the postage simultaneously with the dispatch of the letter.

- Please do not forget to change the password upon the first login.

Yes, you must change

your password in any case after you have concluded the Internet bank contract

or if we sent a new password to you.

You will only be able

to use all services of the Internet bank after changing your password. In

addition, for your own safety, please change your password regularly.

Login problems

You can request a new password in any of our branches. Please do not forget to change the new password upon the first login.

- If you are a commercial banking customer, you can request a new password only in person in your home branch.

- If you are a retail

customer, you stay permanently abroad and have forgotten your password, send us

an e-mail to informacio@otpbank.hu:

- Request a new password in your mail.

- In our response, we shall send you a declaration related to the issue of a new password.

- Have the declaration certified

by the Hungarian embassy and send it to the following address:

OTP Bank Plc

Digital Sales and Development Directorate

1876 Budapest - After having received the declaration, we will send the envelope containing the new password by post to the address specified by you. We will debit your account with the postage simultaneously with the dispatch of the letter.

- Please do not forget to change the password upon the first login.

If you try to

log in to the Internet bank and you mistype your password three times in

succession, your ID will be suspended for 24 hours due to security reasons.

After 24 hours you can log in again if you type in your password correctly. The

same applies to the SmartBroker service as well as to the registration to the

SmartBank mobile application.

If you do not

wish to wait 24 hours or have forgotten your password:

- visit any of our branches, or

- if you have a contract for OTPdirekt call centre services, call +36 (1/20/30/70) 3 666 666.

If you are a commercial banking customer, we can help you solve this problem only in person in your home branch; so please visit the branch together with the account holder.

If you try to log in

to the Internet bank and you mistype your password three times in succession,

your ID will be suspended for 24 hours due to security reasons. After 24 hours

you can log in again if you type in your password correctly. The same applies

to the SmartBroker service as well as to the registration to the SmartBank

mobile application.

If you do not wish to

wait 24 hours or have forgotten your password:

- if you have a contract for OTPdirekt call centre services, call +36 (1/20/30/70) 3 666 666;

- if you do not have a

contract for OTPdirekt call centre services, send us an e-mail to informacio@otpbank.hu:

- Request a new password in your mail.

- In our response, we shall send you a declaration related to the issue of a new password.

- Have the declaration certified

by the Hungarian embassy and send it to the following address:

OTP Bank Plc

Digital Sales and Development Directorate

1876 Budapest - After having received the declaration, we will send the envelope containing the new password by post to the address specified by you. We will debit your account with the postage simultaneously with the dispatch of the letter.

- Please do not forget to change the password upon the first login.

If you are a commercial banking customer, we can help you solve this problem only in your home branch; so please visit the branch together with the account holder after you have returned to Hungary.

If the timeframe

indicated in the SMS has already expired, try to log in again.

If you have not tried

to log in to the Internet bank recently but you received an SMS, it is possible

that someone else tried to log in with your ID. If this happens, please:

- change your password immediately, and

- report the problem to our staff in any of the branches, or call +36 (1/20/30/70) 3 666 666!

If your mobile phone has no Internet connection, select the "SMS" option under the QR code. In this case, we shall send you the authorisation code in SMS to the phone number specified for Mobile Signature.

You specified one or several login data items erroneously. Upon login pay attention to the following:

- The ID consists of 7 digits at the most, and you can find it in your OTPdirekt contract.

- The account number consists of 16 or 24 digits, and you can find it in your OTPdirekt contract or account statement.

- The password consists of 6 to 8 characters, and must include numbers, lower and upper case letters.

- Your own unique ID consists of 9 to 40 characters and must not start with a number.

- Make sure that the Caps Lock button is not on when you type in the data.

If you still cannot log in, visit any of our branches, where our staff will provide you with your login data and reset your password!

Transaction execution

You can access

the Internet bank 7 days a week and 24 hours a day.

Whether or not

it is a banking day, we immediately execute:

- prompt transfers between OTP bank cards,

- motorway toll payment, and

- top-up of mobile phone cards.

You can access any time:

- your account history,

- the turnover data, and

- in the case of term deposits and corporate accounts, the queuing items.

The credit transfers

submitted on banking days are executed on the same day during the opening

hours. If you initiate a credit transfer outside the opening hours, it will be

executed on the next working day.

Opening hours:

for intrabank credit transfers, until 7 p.m. on working days.If you make an

interbank credit transfer you have to initiate your order on working days until

4:30 p.m. for same day execution.

If you place your deposit outside opening hours, it will be fulfilled on the next banking day, applying the interest rate prevailing on that day. Thus in this case it may happen that the effective interest rate differs from the one you saw upon submitting the order.

Credit transfer

If the amount that you wish to transfer exceeds the daily limit you had specified for the Internet channel, we are not in the position to execute the transaction. If you wish to change the daily limit:

- visit any of our branches, or

- if you have a contract for OTPdirekt call centre services, call +36 (1/20/30/70) 3 666 666.

If you are a commercial banking customer, you can initiate the limit amendment only in person in your home branch.

You can transfer funds from an OTP bank card to another OTP bank card immediately, even during the night or weekend. You can initiate such transaction through the Internet bank in the Bank account / Credit transfers / 7*24 hours, Prompt transfer between OTP bank cards menu item.

You may enquire about, modify or cancel the orders awaiting execution

- through the Internet bank, in the Bank account / Credit transfers / Maintenance of value dated and standing orders menu item, or

- via the call centre service at +36 (1/20/30/70) 3 666 666, or

- in any of our branches.

In the Internet bank

you can check your order in the Bank account / Enquiries / Checking, approving,

signing transactions menu item.

If the status of your

order is:

- pending or awaiting processing, it will be executed on the next banking day at start of day. Before your order is executed you can cancel it any time;

- awaiting approval, then your order has been captured, but it will be executed only if you approve it within 1 hour from the capturing. You can approve your order with the code sent in SMS by Mobile Signature, or by scanning the QR code if you have registered for SmartBank;

- executed, then your order has been processed. Your order will be executed on the day that you have specified, taking into account the opening hours;

- rejected during processing, then it was rejected during processing;

- rejected, then you have failed to approve the transaction within the applicable time frame;

- cancelled, then you have cancelled the transaction prior to execution;

- awaiting signature, then, as it is an order placed by a commercial banking customer, a signature of minimum 10 scores is necessary for the execution, which has to be provided within 24 hours.

We will always notify you in a Mailbox message when your stored order has been executed or rejected. You can check the result of the orders in the Bank account / Enquiries / Account history menu item and on the account statement as well.

With the templates

you can save the details of your frequent transactions, thus you can perform

them faster. For example, if you make payments to the same person or company

regularly, you can save it as a template. In this way you do not need to fill

in the beneficiary's name and bank account number every time.

If you need a

confirmation of a specific transaction (e.g. that the payment has been

executed), use the "Save transaction"

button after completing the transaction.

Technical issues

For using the Internet bank does not require any special browser settings.

If you perform no transactions in the Internet bank for a longer period after logging in, you will be logged out for security reasons. This is to prevent unauthorised persons from using your account. If you wish to continue using the Internet bank, you will have to log in again.

- We recommend that if you do not regularly switch your phone off and on again, and then do it now.

- If you still do not receive the SMS, call our customer service at +36 (1/20/30/70) 3 666 666.

- If our call centre staff confirms that the bank did send the SMS, then call the customer service of your mobile provider.

If you have specified in the settings that the Internet bank should require a password for each transaction:

- you have to submit the order (e.g. credit transfer),

- enter your password,

- and only then will we send you the SMS.

If you use Mobile Signature, we can only execute the transaction if you:

- enter the code received in SMS at the bottom of the screen confirming successful processing or in the Checking, approving, signing transactions menu item, or

- approve the transaction with a QR code, if you are a registered SmartBank user.

If you are a commercial banking customer, you also have to add signatures of an appropriate score to the orders in the Bank account / Enquiries / Checking, approving, signing transactions menu item. At present, the execution of orders requires 10 scores. If this is not performed within 24 hours, the order will be cancelled.

In mobile browsers you will see an automatically mobile optimised Internet banking interface, which offers limited services. If you wish to use the full Internet banking functionality on your mobile phone, click on the "full functionality view" link.

Probably a technical problem occurred in the banking system. Wait a few minutes and try to log in again. If your login attempt fails several times, please contact our customer service at +36 (1/20/30/70) 3 666 666!

Service-related questions

We apply

state-of-the-art information security technology. Data traffic is encrypted by

128-byte keys. Through approval by Mobile Signature (SMS or QR code, if you are

a registered SmartBank user), in addition to the private password known only to

you, a one-time code offers a second level of security, protecting login and the

initiation of transactions.

For your security,

please don’t forget to do the following:

- Set the highest data security level in your browser.

- Use the Mobile

Signature service. Upon login and transaction initiation, we will send you a one-time

identification number in SMS, which you can use for approving the transaction.

You can only use each identification number once.

If you also use the SmartBank mobile application, we display a QR code in the interface instead of sending an SMS. You have to scan the code with the SmartBank application in order to approve the transaction.

Commercial banking

customers are also required to add a signature of an appropriate value (10

scores in total), in addition to applying the Mobile Signature, for the

transaction to be executed.

Please check out our security

page, where you will find additional useful information.

Yes, it is possible to use it more simply, with fewer SMS messages:

- Go to the Settings menu in the Internet bank.

- Select the Mobile Signature settings menu item.

- Set the "Transaction confirmation – Simplified" option.

After this, if you

initiate a transaction by using a saved template, you will receive no SMS for

the approval. If you are a retail customer, you will not receive an SMS for

transactions between your own accounts managed in the Internet bank.

If you wish to use

the Internet bank in an even simpler manner, register for the SmartBank mobile

application, through which you can use QR code-based Mobile Signature. This enables

you to approve login and transactions by scanning the QR code instead of SMS.

Some of the transactions are not posted immediately, only a few days later. Purchases made by bank cards are a typical example. The booked balance does not include the transactions "in transit", while the available balance includes all transactions. The available balance is the amount that you can actually use.

You may enquire about

your account statements as from 2011.

If you do not

find an account statement,

- you may be enquiring about a period for which the statement has not been generated yet, or

- if you are a commercial banking customer, the authentic e-statement might not have been generated yet for the period you are enquiring about.