These segments of chip-making is worth paying attention

Related content

Only Consumer staples stocks are thriving

We are still finding stocks showing significant strength primarily in the basic consumer goods sector. The sector gained momentum last week and has since had a particularly strong week, with many companies joining in. During the week, Molson Coors Beverage and Target shares showed strong buying confirmation.

International Markets - Technical Analysis

Two weeks ago, the indices attempted to break out upwards, but following unsuccessful attempts at growth, a strong wave of selling arrived, led primarily by the technology sector. Markets underwent a sharp correction, which also broke the long upward trends. The most important question at this point is whether this was just a temporary setback and the upward trend will soon resume, or whether we are seeing the beginning of a more prolonged negative process. We may get an answer to this question this week: if the correction attempts that began last Friday run out of steam within a few days and are followed by another few days of heavy selling, then a trend-like decline in the markets may become almost inevitable. For the time being, only a moderate decline can be seen on European stock exchanges, although there are already signs of a long close here as well. The emerging market index also shows a pattern reminiscent of a long close, although a significant correction scenario has not yet materialized here.

The semiconductor industry could reach another historic milestone by 2026, with the global market approaching $1 trillion, driven by stronger-than-ever AI-driven demand. The growth engine is logic and memory chips, as data center investments are driving unprecedented demand for GPUs, ASICs, and HBM solutions. However, performance within the sector is not uniform: AI-related areas enjoying structural growth are outperforming spectacularly, while the analog, PC, and smartphone markets are showing a slow and mixed recovery. Following our previous article on semiconductor sector segments and supply chain risks, this time we focus on the industry's growth prospects, catalysts affecting different areas, and cyclicality as the main risk.

Our previous analysis presenting the industry background is available at the this link.

Drivers of the semiconductor industry

According to estimates by World Semiconductor Trade Statistics, the industry could reach $975 billion by the end of 2026, representing 26% YoY growth, which would mean an acceleration in growth momentum from 22.5% in 2025. Geographically, all major regional markets are expected to expand in 2026, with America's growth of over 34% being the primary driver, followed by Asia with 25% expansion. Among the various product categories, memory and logic chips are expected to continue to play a leading role, both with annual growth of more than 30%. Most other product categories are expected to continue their gradual recovery, expanding at a more moderate pace than in previous cycles.

Logic chips

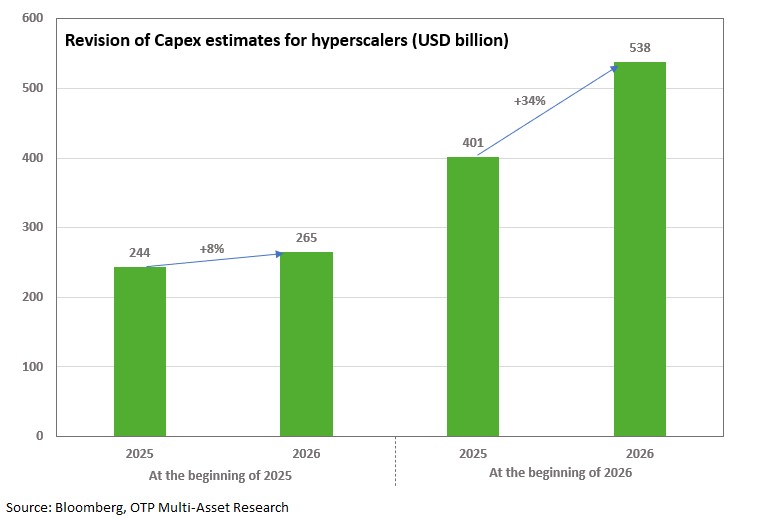

The primary catalyst for the industry continues to be AI infrastructure investments, which are primarily driving demand for high-performance logic chips. The Capex plans of US hyperscalers—Google, Microsoft, Amazon, Meta, and Oracle—for 2026 have nearly doubled over the past year (and several leading companies have announced further Capex increases during the current earnings season), with the vast majority of this investment going toward expanding data center capacity. Since GPUs and custom-designed AI chips (ASICs) are the biggest cost drivers in these systems, capital typically ends up in this segment. In addition to large technology companies, OpenAI plans to spend an additional ~$1 trillion on investments by 2030, while the weight of government artificial intelligence projects could reach 20-40% of global AI Capex by the end of the decade, up from virtually zero today, further driving demand.

At the same time, there are significant risks associated with OpenAI's ability to fulfill its long-term commitments. The company generates only about $20 billion in annual revenue, and according to its own projections, it is not expected to generate positive cash flow before 2029, which raises questions about whether it will be able to maintain its current investment and capacity expansion commitments from a financing perspective. These uncertainties are also priced in to some extent by the market, with the shares of companies whose growth prospects are closely linked to OpenAI's orders underperforming relative to the market (e.g., Oracle, where significant debt financing further increases the risk). However, it is important to emphasize that OpenAI is backed by financially strong strategic partners such as Microsoft and Nvidia, which have a fundamental interest in preserving the value of their investments, and is also a key customer for leading chip manufacturers. In light of this, we consider the risk of the planned investments being completely derailed to be limited; a shift in timing or a more moderate adjustment of commitments seems a more realistic scenario. However, the market has already priced in these risks to some extent, given the performance of the shares of the companies concerned.

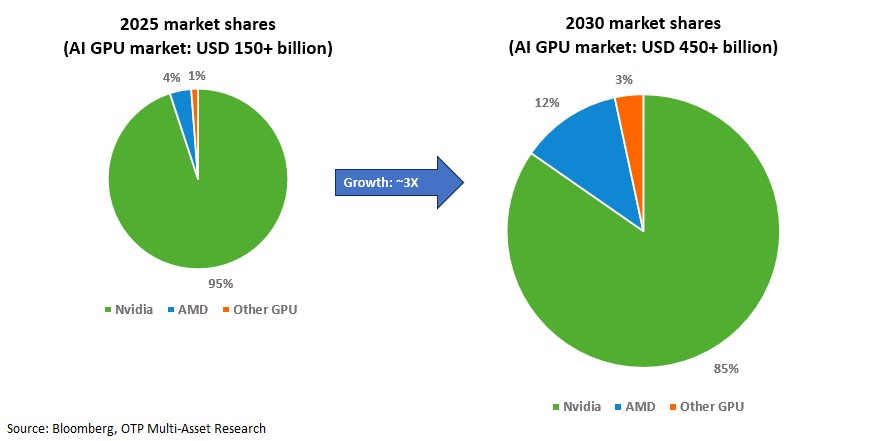

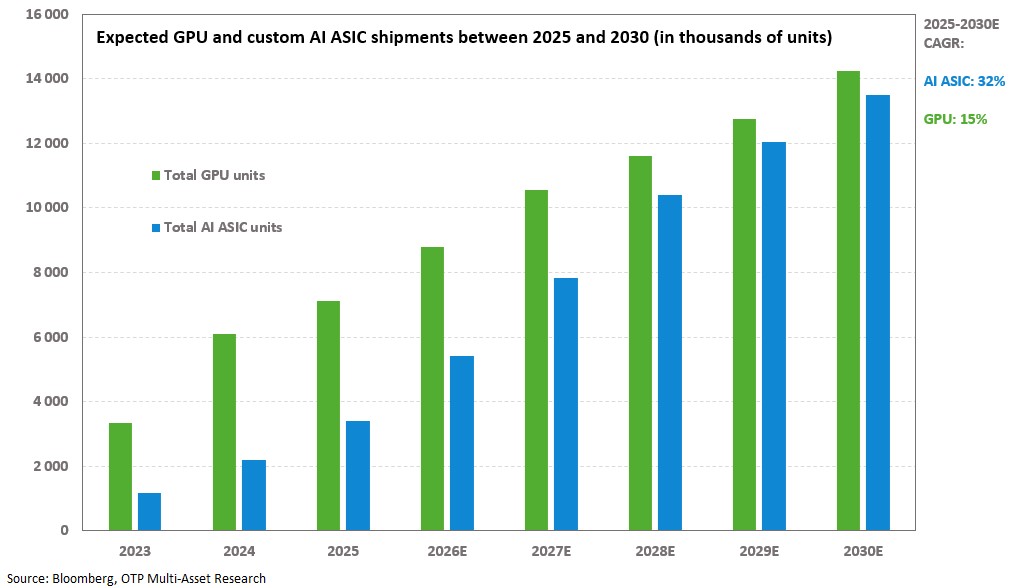

The market for AI chips used in data centers is currently dominated by GPUs, which account for nearly 90% of the market, while ASICs account for only around 10%. The advantage of GPUs is their wide range of applications and high computing power, especially in the training phase of large models, which makes them extremely difficult to replace in the short term. As a result, they are likely to continue to be one of the biggest beneficiaries of the investment cycle, with the market size potentially tripling by 2030. The segment is highly concentrated: Nvidia is virtually dominant with a market share of over 90%, while AMD is the second largest player, but much smaller. Nvidia's continuous product development and software ecosystem (especially in the area of performance optimization) seem to ensure that its leading position is sustainable, which gives its products significant pricing power. As a result, an Nvidia GPU costs nearly five times as much as an average custom-designed AI chip, while AMD GPUs cost roughly three times as much as AI ASICs.

The strengths of custom-designed AI chips come to the fore primarily when using pre-trained AI models, as they can be optimized for specific tasks and are energy efficient. Google's TPU i and Meta's proprietary accelerators are optimized primarily for search and ad targeting tasks, but TPUs can outperform Meta's chips in other areas. AWS Trainium chips and Microsoft's similar product are solutions specialized for inference at scale. As the focus shifts from model training to usage, these specialized chips may gain market share from GPUs, which will allow them to grow faster due to their low base. However, the pricing premium for GPUs is expected to remain, even if the difference between the two segments in terms of unit shipments gradually narrows. Broadcom is the leader in the AI-ASIC market with a market share of around 70%, with Marvell Technology being the only other significant player in the market.

Within logic chips, the CPU segment has clearly underperformed the GPU and ASIC markets in recent years, as it has largely missed out on the structural demand growth generated by artificial intelligence. CPUs remain primarily tied to consumer end-markets, particularly PC sales, resulting in much higher cyclicality compared to the AI-oriented parts of the sector. Although the share of PCs with AI features is expected to increase in the coming years, which could improve the revenue structure through a premium product mix, limited use cases and high system costs mean that this alone will not be a significant structural growth catalyst for the CPU market. Thus, although the average selling price may rise, the impact on sales volume may be limited.

Memory chips

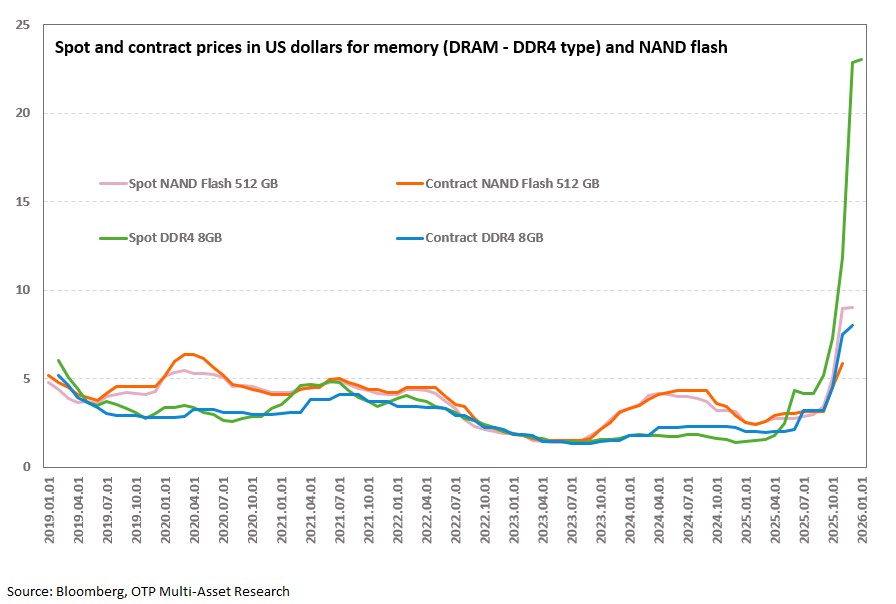

Within the memory chip market, the primary driver of the DRAM segment is the extremely strong demand for high-bandwidth memory chips (HBM), which is supported by data center investments. HBM, which is becoming a critical component of AI infrastructure, is a higher-margin memory product than the solutions required for standard PCs and smartphones, so manufacturers have increasingly shifted their production focus to this product range. However, this process has led to a supply shortage in the more traditional memory market, resulting in explosive price increases. The growth momentum seen in recent months may slow down in the first half of the year due to healthier inventory levels at PC and smartphone manufacturers (Dell, HP, Lenovo, Apple), which reduce demand pressure. However, pricing may improve significantly again in the second half of the year as HBMs increase their share of memory products, putting pressure on traditional DRAM supply.

Memory chip manufacturers are expected to begin shipping next-generation HBM4 chips in the middle of this year, which could result in a price increase of at least 30% per gigabyte compared to the most advanced HBM3e products currently available. These solutions provide greater bandwidth, resulting in faster training and execution for AI models, and are also suitable for running models with a larger number of parameters, all in an energy-efficient manner compared to previous-generation memory chips. In the second half of the year, new-generation chips could account for a significant portion of HBM sales thanks to the introduction of Nvidia's Rubin GPU (which requires more memory), which is already based on HBM4. Demand for HBM is also being driven by growing sales of custom-designed AI chips (ASICs), given that it plays an important role in both the training and inference phases of AI models. Industry estimates suggest that the HBM market could be worth around $35 billion in 2025, growing to as much as $68 billion by the end of 2026, reflecting the segment's extremely dynamic growth trajectory.

Similar processes to those seen in the DRAM market have also taken place in the NAND (non-volatile memory) sector. Artificial intelligence is driving demand for higher-capacity SSDs, which could more than offset potentially weaker PC and smartphone sales and push up NAND prices due to tight supply. Currently, memory chip manufacturers are reluctant to expand NAND capacity, as they are redirecting resources primarily to higher-margin HBM products, so strong AI-driven demand may continue to support higher prices throughout this year. Thanks to these developments, industry players (Micron, SK Hynix, Samsung) have posted significant upward EPS revisions and are starting the year with strong earnings momentum.

Analog chips

In recent years, the analog chip segment has lagged behind, as investments have mostly not been concentrated on projects related to them. Their end-markets are cyclical, and although there are signs of a recovery, the upturn is slower than in previous cycles at this stage. This delays the improvement in capacity utilization, which hinders the realization of economies of scale, so margins may remain under pressure. Companies in the segment show mixed fundamentals and divergent outlooks, with analysts' consensus expecting only single-digit revenue growth by 2026.

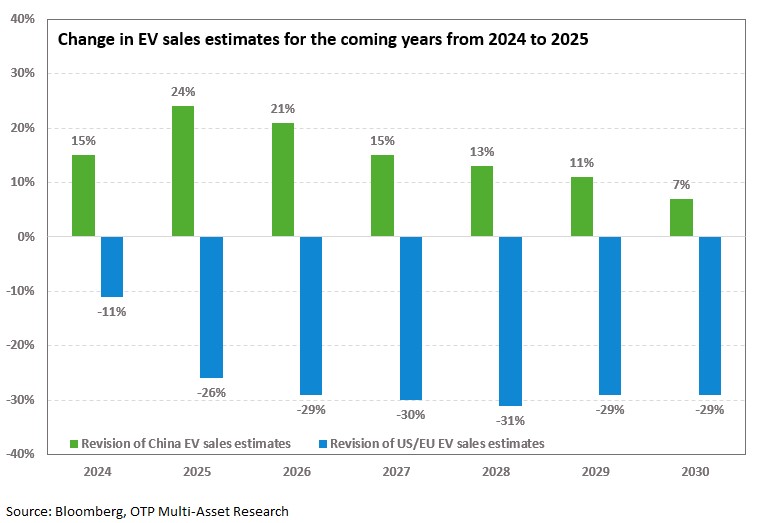

Among the areas of application, the outlook for the industrial and automotive markets has improved somewhat, particularly for more diversified players such as Texas Instruments, Infineon, and Analog Devices. At the same time, electric vehicle sales, as a potential catalyst, continue to present a mixed picture: Forecasts have improved in China, while sales revisions in Europe and the US have tended to be downward. In contrast, the PC and smartphone market as an end-user area has stabilized after last year's turbulence caused by tariffs.

As in the PC market, the proportion of devices equipped with AI features within total sales may increase in the smartphone market, which may primarily support average selling prices, but is expected to have a limited impact on volumes. An additional risk is that the sharp rise in the price of traditional memory products during the year could be passed on to end-user prices, which could dampen demand in both the PC and smartphone markets. In the longer term, however, the gradual spread of IoT, robotics, and autonomous systems could be a new catalyst for demand for analog chips

Supply and demand conditions, cyclicality, inventories

In addition to the geopolitical factors presented in the previous part of our analysis series, cyclicality is one of the most significant risks that fundamentally influences the valuation of the industry. In a normal market environment, analog chips can be considered the least cyclical part of the semiconductor sector, as their wide range of applications – including healthcare and other industries with more stable investment cycles – mitigate demand fluctuations.

In contrast, logic chips are much more cyclical, as many of their end markets, such as the PC and smartphone segments, are sensitive to short-term changes in demand. In recent years, however, the construction of AI data centers has created a new pillar of structural growth, particularly in the GPU and ASIC segments. This trend significantly reduces the risks associated with cyclicality and contributes to the expansion of the valuation multiples of related companies.

Within the semiconductor sector, memory chips are considered the most cyclical area, which is why they traditionally have the lowest valuation levels. End-user demand is extremely volatile in PC, mobile, server, and automotive applications, while the inflexibility of manufacturing capacity often leads to oversupply. In addition, market players tend to overinvest during upturns, which later leads to high fixed costs during the downturn and can result in an even greater decline in profits than in revenues, and in extreme cases, even losses. However, the enormous memory requirements of data centers could lead to structural growth in the industry, which could transform the traditional image of the segment: instead of a highly cyclical segment, it could become a bottleneck for AI infrastructure in the future, leading to repricing in the area.

Within the industry, there appears to be strong demand in the logic chip market, particularly in the GPU and ASIC markets, as well as in the memory chip market. Broadcom, a leading company in the ASIC field, expects AI-related sales to grow by 100% by 2026, based on contracted but not yet realized revenues (backlog). Nvidia, the dominant player in the GPU market, has a backlog of more than $500 billion for the 2025-2026 period, which could lead to more than 50% growth in corporate-level sales this year. However, demand is putting even greater pressure on the memory chip segment: leading manufacturers have already contracted out a significant portion of their capacity for this year—in some cases, virtually all of it—while only being able to partially meet the needs of their key customers; Micron, for example, is expected to be able to fulfill only about two-thirds of its orders.

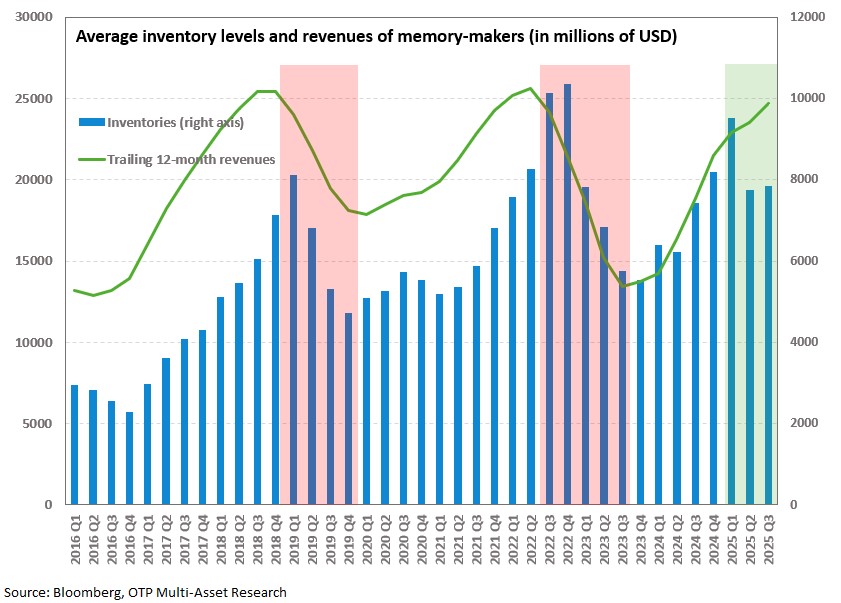

Due to the high cyclicality of memory chips, current inventory levels are particularly important in this area, in addition to supply and demand conditions. During previous growth cycles in the industry, inventory accumulation was typical, but this does not appear to be the case in the current cycle, with inventory levels falling in recent quarters and days of inventory declining for years. This much healthier inventory position suggests that even if supply were to move closer to demand over time, the deep corrections in memory prices seen in the past would not necessarily return (or at least not immediately). The current cycle thus appears to be more resilient and sustainable than previous ones.

Overall, AI-driven segments - primarily GPUs and AI-specific ASICs within logic chips, as well as the memory chip market - continue to show the greatest upside potential. In these categories, sustained strong demand supports not only volume growth but also corporate margins, which has a positive impact on valuation levels. In contrast, the real catalyst for analog chips is yet to come, but structural themes such as self-driving cars and robotics may eventually fill this role.

Get more out of your investments!

Global Markets Services

OTP Global Markets offers a broad range of services in the field of local and international money and capital markets.

Read morePrivate Banking Services

Personal care and expertise with OTP Private Banking, along with the knowledge, security, and innovations of a multinational banking group.

Read more