The building blocks of the future: what you need to know about chips

Related content

Only Consumer staples stocks are thriving

We are still finding stocks showing significant strength primarily in the basic consumer goods sector. The sector gained momentum last week and has since had a particularly strong week, with many companies joining in. During the week, Molson Coors Beverage and Target shares showed strong buying confirmation.

International Markets - Technical Analysis

Two weeks ago, the indices attempted to break out upwards, but following unsuccessful attempts at growth, a strong wave of selling arrived, led primarily by the technology sector. Markets underwent a sharp correction, which also broke the long upward trends. The most important question at this point is whether this was just a temporary setback and the upward trend will soon resume, or whether we are seeing the beginning of a more prolonged negative process. We may get an answer to this question this week: if the correction attempts that began last Friday run out of steam within a few days and are followed by another few days of heavy selling, then a trend-like decline in the markets may become almost inevitable. For the time being, only a moderate decline can be seen on European stock exchanges, although there are already signs of a long close here as well. The emerging market index also shows a pattern reminiscent of a long close, although a significant correction scenario has not yet materialized here.

The semiconductor sector was one of the best performers in 2025, with an annual return of nearly 40%, and the start of 2026 has also been strong. At the same time, performance within the industry varies significantly: not all companies have been able to show growth. Different segments of chip manufacturing have different areas of application, which are associated with different fundamental outlooks and performance. Furthermore, a deeper understanding of industry trends requires mapping supply chains and manufacturing structures, which are key not only in terms of technological dynamics but also geopolitical risks. The first part of our series of analyses on the semiconductor sector serves to provide a deeper understanding of this industry, which is also highlighted in the Investment Outlook, presenting the key segments and supply chain risks that determine the sector's long-term outlook.

The semiconductor industry is not homogeneous: chip manufacturing can be divided into three main categories—logic, memory, and analog solutions—which are designed for different areas of application and, as a result, have different technology cycles, demand dynamics, and profitability. To understand the industry outlook, it is essential to examine these segments separately.

Chips broken down by category

Logic chips are one of the key areas of the industry, as they are responsible for data processing and control functions, essentially forming the "brain" of modern electronic systems. This includes, for example, the CPU (Central Processing Unit), which is the basic processing unit of computers, executing instructions in sequence and performing general-purpose computing tasks. Demand is primarily concentrated in the PC and server markets, so it correlates strongly with macroeconomic cycles and consumer spending. In recent years, this segment has been a relative underperformer within the industry, as reflected in the weak share price trend of one of the leading players, Intel, in recent years (except for last year, when specific news helped, but more on that later): the stock has lost about 20% of its value in three years.

In contrast, GPUs (Graphics Processing Units) were originally designed for graphics calculations, primarily for video games, but their parallel processing capabilities make them ideal for large-scale data processing. This feature has made them crucial for training and running AI models. As a result, the focus of use has now shifted to data centers, where Nvidia dominates the market with a share of more than 90%. These chips are technologically more complex than, for example, the memory products required for computers, which makes them difficult to copy. Unlike CPUs, the GPU segment is less sensitive to economic cycles, similar to application-specific integrated circuits (ASICs), which have also come to the fore with the rise of AI data centers.

Broadcom is the leading player in the AI-specific ASIC market with a market share of nearly 70%. ASICs are single-purpose solutions optimized for a specific task, such as Google's TPU, which delivers outstanding performance in matrix multiplication, which is the basis of neural networks and therefore perfect for AI models. This allows them to offer competitive, and in some cases even better, performance than GPUs while consuming less energy, which means they can gain market share in the AI chip market in the long term, especially as the inference phase becomes more important in new AI models (although they are also suitable for training). The reason for this is that inference requires less computing power, but energy efficiency is very important, and ASICs excel in this area.

Another major category is memory chips, which can be divided into two main areas: fast, temporary memory (DRAM) and memory suitable for long-term storage (NAND). A good example of the former is the RAM used in computers, while the latter category includes SSDs, for example. Demand is primarily generated by PCs, smartphones, automotive driver assistance systems (ADAS), and industrial applications, but with the rise of data centers, memory chips have become a critical infrastructure component (data centers have extremely high memory requirements). The products are typically standardized and easy to copy, which creates a highly competitive environment.

At the same time, high-bandwidth memory (HBM), which enables high data transfer speeds in data centers, is a more complex chip with higher added value and thus higher margins. Manufacturers' capacity allocation in 2025 has clearly shifted towards HBM, and robust demand and a higher-margin product mix have made memory chip manufacturers one of the best-performing segments in the US market. Leading players in the industry include Micron in the US and Samsung and SK Hynix in South Korea, which focus primarily on DRAM products. In addition, Western Digital and Seagate dominate in the US, specializing mainly in NAND-based storage solutions.

The next area is the analog chip segment, which enables the processing of continuous signals from the real world (such as sound, light, and temperature), as opposed to the binary logic of digital chips. These solutions play a fundamental role in the interface between the physical environment and digital systems, for example through data conversion and sensor technology. Analog chips have a wide range of applications: in the automotive industry (electric vehicles, ADAS systems, self-driving cars), industrial automation, telecommunications, and smartphones and consumer electronics. This segment is typically more stable and less cyclical than the market for memory or logic chips. Leading players in the market include Texas Instruments, Analog Devices, and Infineon, which have a strong position particularly in automotive and industrial applications.

Supply chain and structure

There are two basic business models in the semiconductor industry: vertically integrated companies, which cover the entire value chain from chip design to manufacturing (e.g., Samsung), and the "fabless" model, where companies focus exclusively on design and outsource manufacturing to external partners. Most large US companies, such as Nvidia, Broadcom, and AMD, operate under a fabless structure and have their products manufactured by Taiwan-based TSMC. In contrast, Intel is the only major US player with its own manufacturing capacity, but due to its technological lag, it is currently not competitive in the field of AI chip manufacturing.

One of the best-known companies providing manufacturing services is Taiwan Semiconductor Manufacturing Company (TSMC), which operates in a so-called "pure-play" foundry model, meaning that it does not develop its own processors, but manufactures chips based on its customers' designs. TSMC manufactures the world's most advanced chips, made possible by its market-leading manufacturing technology. Their 2-nanometer chips, the first of their kind in the semiconductor industry, which is moving towards miniaturization, enable greater computing capacity and lower energy consumption with 50 billion transistors (high transistor density). Although Samsung has also introduced 2-nanometer manufacturing technology, its manufacturing business is less cost-effective than TSMC's due to lower production volumes, while Intel's manufacturing technology continues to lag behind the competition. The areas of application are wide-ranging: AI data center chips (primarily TSMC), memory chips (Samsung), CPUs for computers (Intel), and semiconductors for smartphones and industrial applications.

Nevertheless, the US government attaches strategic importance to Intel's manufacturing capabilities, as evidenced by its acquisition of a 10% stake in the semiconductor company in 2025. The company could play an important role in ensuring that the most advanced AI chips are manufactured on American soil in the long term, in line with US government interests, reducing geopolitical exposure and strengthening technological sovereignty. This narrative is reinforced by the fact that Nvidia also bought a stake in Intel last year. The two transactions have given new momentum to Intel shares, which have been struggling for years.

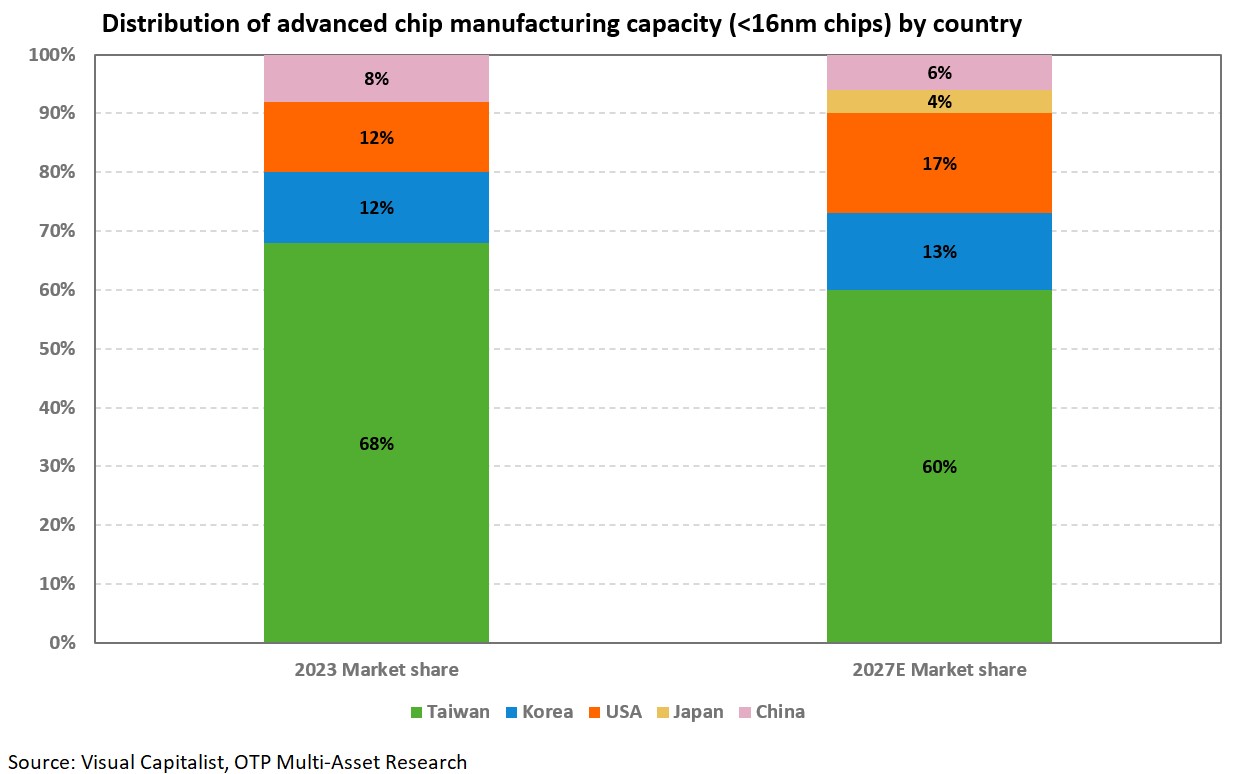

In addition, the US imposed a 100% tariff in 2025 on semiconductor companies that do not install part of their chip manufacturing capacity in the United States (in which case they are exempt from customs duties). TSMC had already announced investments in the US, but in the first half of last year it made a further commitment of $100 billion to build three new chip manufacturing plants, two advanced packaging plants and a major research and development center in Arizona.* The aim of the investments is to increase the security of the US supply chain and reduce dependence on semiconductors manufactured in Taiwan. However, the projects are unlikely to be implemented in the short term, given that the deadline for the company's previous investment commitments is already 2030. Thus, in the short term, the US national security priority remains the defense of Taiwan against possible Chinese aggression, as about two-thirds of modern chip manufacturing (miniaturized chips smaller than 16 nanometers) is linked to TSMC, and Taiwan also has a dominant position in R&D.

The geopolitical risks to the semiconductor industry supply chain are not limited to manufacturing technology. In addition to silicon, gallium and germanium are also critical raw materials in chip manufacturing, and China is the world leader in the extraction and processing of these metals. Restricting exports of these materials could be an effective tool in a trade war with the United States. The competition between the US and China in the field of artificial intelligence further increases the strategic importance of access to modern chip manufacturing technologies and raw materials. As a result, the semiconductor supply chain may face persistently high geopolitical risks, which could affect the industry's long-term prospects.

*Update: On January 15, news broke that the United States and Taiwan had reached a trade agreement that would reduce US tariffs from 20% to 15%. In return, Taiwanese technology companies would have to invest $250 billion in the US. As a result, TSMC would undertake to build six additional chip factories, in addition to the investments already announced. The US government's strategic goal is to relocate approximately 40% of Taiwan's semiconductor manufacturing capacity to the United States. No deadline has been set for the projects, but based on previous announcements, it is unlikely that they will be completed before 2030.

Get more out of your investments!

Global Markets Services

OTP Global Markets offers a broad range of services in the field of local and international money and capital markets.

Read morePrivate Banking Services

Personal care and expertise with OTP Private Banking, along with the knowledge, security, and innovations of a multinational banking group.

Read more