Hungary: The MNB cautiously opens the door for the easing in Q1; the base rate was left at 6.5%

Related content

Commodities - Technical Analysis

After a deeper correction in gold and silver, the recovery that followed turned into a decisive upswing last Friday. In the coming days, the key question will be whether prices turn lower again from ideal corrective levels, or whether the market attempts to challenge the historical highs. Oil remains in a well-defined upward trend with room to extend further. Natural gas is drifting slightly lower without giving meaningful signals — overall a neutral setup. Copper is showing a modest post-correction rebound, but it is still too early to call for a sustained trend reversal. Wheat continues to push higher in a strong trend towards the 593 level. Corn could begin a meaningful move higher within days if it manages to break above its descending trendline.

EOG Resources: better than expected results, strong cash generation

EOG Resources published its fourth quarter earnings report on Tuesday after the market closed, which was generally positive, with the company slightly beating analysts' expectations. On an annual basis, results are weaker due to lower oil prices, which higher production volumes were only able to partially offset. Nevertheless, free cash flow generation remains strong, which EOG is fully allocating to dividend payments and share buybacks. Management expects high free cash flow generation to continue in 2026, although it may be slightly lower than last year. We are therefore keeping our trading idea open for now, which is ~9% higher compared to our recommended entry level at the end of January, with the same target price of USD 134.35. In the short term, however, a correction is possible based on the technical picture. We will reassess our idea in the coming period based on the depth and shape of this correction. The level around 112.5 is considered as a strong support, so if the price falls below this, it would definitely be negative. On the other hand, it would be a good sign if the stock can remain above 118.

As expected, the MNB’s Monetary Council left the base rate at 6.5% at its December meeting. The forward guidance became more dovish, as the press release now includes that a data-driven, meeting to meeting approach will be followed looking ahead. The focus will be on repricings at the start of the year and the stability of financial markets.

The MNB's key messages:

· Inflation risks to the baseline scenario have become balanced.

· The Monetary Council is committed to achieving the inflation target in a sustainable manner. According to the MNB's new Inflation Report, this is likely to happen in the second half of 2027.

· Inflation will briefly decline below the inflation target in early 2026 before temporarily rising near the upper bound of the tolerance band. Underlying inflation (of goods and services) is forecasted to fall to the target in H2 2026.

· A careful and patient approach to monetary policy remains necessary due to risks to the inflation environment. In the Council’s assessment, maintaining tight monetary conditions is warranted.

· To the forward guidance of the press release a new part was added: The Council is constantly assessing incoming macroeconomic data and factors influencing the inflation outlook, in particular repricings at the start of the year and the stability of financial markets, based on which it will take decisions on the level of the base rate in a cautious and data-driven manner from meeting to meeting.

· Besides the price adjustment at the start of 2026, the timing and impact of the withdrawal of price restriction measures will be important in terms of the inflation outlook.

· Household inflation expectations are above target and have risen slightly compared to the previous month.

· The MNB remains committed to ensuring positive real interest rates in support of achieving inflation in a sustainable manner.

· GDP growth could be 0.5% this year, 2.4% in 2026, 3.1% in 2027, and 2.7% in 2028, according to the new Inflation Report.

· The inflation projection changed compared to the September Inflation Report, from 4.6% to 4.4% for 2025, from 3.8% to 3.2% for 2026, and from 3.0% to 3.3% for 2027.

Market reactions:

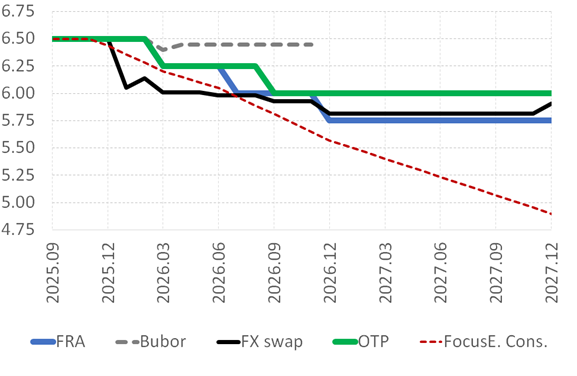

After the publication of the press release rate cutting expectations strengthened. Previously the market expected three 25 bps cuts, one in Q2 and one in Q4 and one in 2027. Current pricing suggest that the first cut could take place in Q1, the second in Q3 and the third in next December. The HUF weakened modestly, by 0.3-0.4% against the EUR, from 384 to 385.5. Yields fell slightly, FRA-as and the FX swap implied yield curve shifted down by 5-10 bps, while the IRS and bond yield curve by around 5 bps.

Before the decision: No rate change was foreseen

The external data of the past month did not really support a short-term decrease in Hungarian interest rates. Although the Fed finally cut its key interest rate for the third time, the weakening of the dollar has stalled, and US interest rate cut expectations have not changed significantly in the past month. However, the market is pricing in at least one 25-basis-point interest rate hike, rather than a hold, from the ECB by the end of 2026. In Hungary, inflation decelerated faster than expected, to 3.8%, but the decline was primarily caused by food prices; the measures of underlying inflation still signify 4-5% inflation. Accordingly, interest rate cut expectations have weakened in Hungary: the market is pricing no more than two interest rate cuts next year, and this is also our forecast: one in September and one in December.

Our assessment: We also revise our base rate expectations, we expect two cuts in 2026, one in Q1 and one in Q3

We interpreted the change in MNB’s forward guidance, which became more dovish than before, as the MNB cautiously open the door for a rate cut in Q1. Our forecast for 2026 has changed in such a way that, whereas we previously expected a 25 bps rate cut in September and another in December, while now we expect a 25 basis point cut in Q1 and another in Q3.

Because of slightly lower-than-expected November inflation data, our annual average inflation forecast for 2025 has been reduced to 4.4% due to rounding, while we left our 2026 inflation forecast unchanged at 3.4%. We think inflation will probably sink well below the 3% target temporarily at the beginning of 2026 because of the delayed excise duty hikes, the expectedly very low re-pricing in administered prices, the strong HUF (vs the EUR), and a significant drop of the oil prices measured in HUF.

We maintain our view that inflation persistence has still not been satisfactorily broken, so the central bank’s caution remains warranted. This is particularly true if we take into account the 11% minimum wage hike next January, and the consumption-stimulating government measures coming into effect these days.

Expectations for the base rate (%)

Sources: Bloomberg, OTP Research, Focus Economics, MNB

Get more out of your investments!

Global Markets Services

OTP Global Markets offers a broad range of services in the field of local and international money and capital markets.

Read morePrivate Banking Services

Personal care and expertise with OTP Private Banking, along with the knowledge, security, and innovations of a multinational banking group.

Read more