Oil companies are in the crosshairs because of Venezuela

Related content

Only Consumer staples stocks are thriving

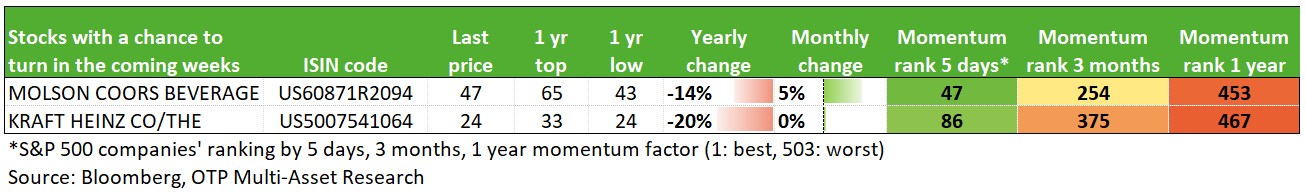

We are still finding stocks showing significant strength primarily in the basic consumer goods sector. The sector gained momentum last week and has since had a particularly strong week, with many companies joining in. During the week, Molson Coors Beverage and Target shares showed strong buying confirmation.

International Markets - Technical Analysis

Two weeks ago, the indices attempted to break out upwards, but following unsuccessful attempts at growth, a strong wave of selling arrived, led primarily by the technology sector. Markets underwent a sharp correction, which also broke the long upward trends. The most important question at this point is whether this was just a temporary setback and the upward trend will soon resume, or whether we are seeing the beginning of a more prolonged negative process. We may get an answer to this question this week: if the correction attempts that began last Friday run out of steam within a few days and are followed by another few days of heavy selling, then a trend-like decline in the markets may become almost inevitable. For the time being, only a moderate decline can be seen on European stock exchanges, although there are already signs of a long close here as well. The emerging market index also shows a pattern reminiscent of a long close, although a significant correction scenario has not yet materialized here.

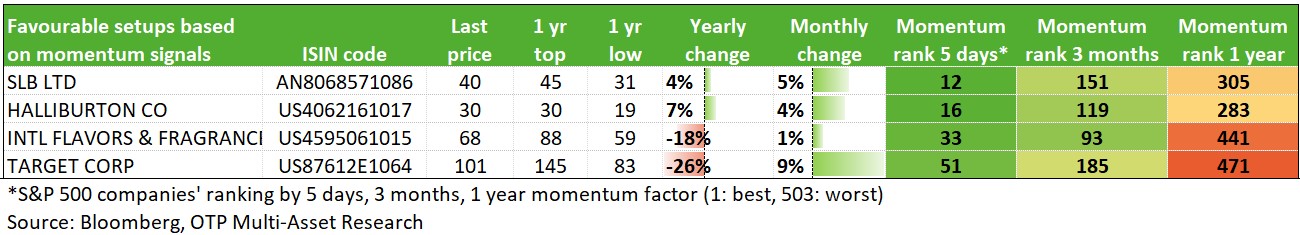

The events in Venezuela have put energy sector stocks in the spotlight. Stocks of companies involved in restoring oil infrastructure were already on an upward trend at the end of the year, but SLB and Halliburton stocks are looking particularly good.

Best rated US stocks based on momentum ranking

Compelling technical picture:

SLB Limited (daily): The turnaround from the long-term downward trend began earlier, in early November. The breakout and retest of 37.5 set the stage for a long trend. Current events have only reinforced the processes that were already underway. Despite the expected rise today, there may still be strength in the stock, and the previous peak may also be targeted.

Halliburton Company (daily): The turnaround, which indicates a high-quality rise, began at the end of October with the gap left open. Since then, it has been characterized by an upward trend, which may shift to a steeper slope in the coming days. Despite the expected rise today, buying opportunities can be found in retests, with the target price here also reaching around 43.75, as in previous years, but since the stock hit a higher low in 2025 compared to the 2020 low, higher target prices may also emerge.

List of stocks with a chance of a turnaround in the coming weeks

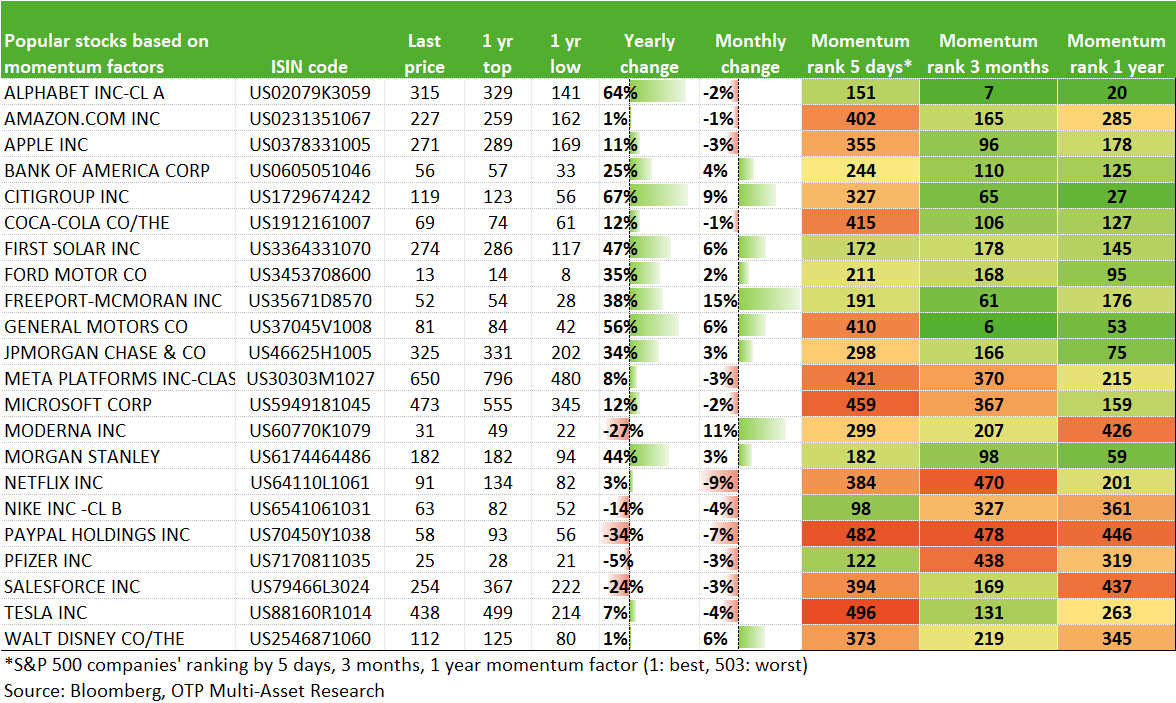

Most popular US stocks

The momentum model supports the creation of a technical based stock list that helps to find shorter-term trading opportunities. The model can be used to identify stocks that show reversal signals following more sustained falls/underperformance. We examine one-year, six-month, three-month, one-month and five-day momentum values, which are used to rank the stocks under consideration. The higher a stock is ranked in the order, the better it technically performs relative to the others. The change in the ranking over time is used to determine the life cycle of the stock.

- In the first table, we collect the stocks that show the most attractive picture compared to the others in a given week based on momentum factors, of which those are also presented in a separate chart where a favourable situation can be identified based on additional technical analysis tools.

- In the second table, we list the stocks that are already worthy of being placed in watchlist status. They are not among the best performers, but they have the potential to improve and signal a turnaround in a few days or weeks.

- In the third table, we have also collected the more popular stocks to help identify their position in the momentum order.

The report shows the results of a technical - quantitative based stock screening, which does not examine the fundamental background/value of the companies. For this reason, risk management/position sizing rules should be designed accordingly.

Get more out of your investments!

Global Markets Services

OTP Global Markets offers a broad range of services in the field of local and international money and capital markets.

Read morePrivate Banking Services

Personal care and expertise with OTP Private Banking, along with the knowledge, security, and innovations of a multinational banking group.

Read more