Japan's fiscal stimulus package may arrive soon

Related content

Hungary: November’s CPI returned to the MNB’s 3% +/-1% target band, but indicators of underlying inflation are still cause for concern

Having stagnated at 4.3% for four months in a row, Hungary's headline inflation declined to 3.8% year-on-year (YoY). This figure was slightly below our forecast (3.9%), and it was lower than the market consensus (4.0%), as well. The lower-than-expected figure was mainly the consequence of the milder-than-expected food inflation. To recap, without the price-reducing administrative measures of the government, inflation would have reached 5-5.5% in November.

Our Equity Top Pick List

Our latest Investment Strategy recommends an overall neutral exposure to the equity asset class over the next 6-12 months. We believe this should be taken into account when making investment decisions in individual equities (the timing of investments or the size of positions).

Although the exact size of the package has only slowly become clear, the new Japanese prime minister's fiscal stimulus package may soon arrive: Meanwhile, some market participants watched with concern to see how much bond issuance would be needed for the stimulus, as well as whether the prime minister would try to pressure the central bank to delay the expected interest rate hikes. As a result, the yen has weakened against the dollar in recent weeks, while Japanese long-term bond yields have crept upward. The Japanese stock market turned down in early November after significant gains in recent months. Although there may still be room for correction in the short term, the trend remains upward in the longer term. Forward-looking profit expectations are rising, and fiscal stimulus and a weaker yen could also support the Japanese stock market in the future. However, potential risks also appeared to be mounting after the prime minister recently criticized companies for focusing too much on shareholders and not paying enough attention to raising wages, hinting that she could review the corporate governance code. If this happens, we will also review our previously optimistic view of the Japanese stock market, which has become somewhat more expensive in the meantime.

Japan's fiscal stimulus package may be coming soon

The election of Sanae Takaichi, who rose to become leader of Japan's Liberal Democratic Party (LDP), as prime minister was not entirely certain for a time after the LDP lost its coalition partner after more than 20 years of cooperation. Shortly thereafter, however, the LDP found a new coalition partner; commentators then took it as almost a given that Takaichi would be elected prime minister due to divisions among the opposition parties, which is what happened shortly thereafter. At the end of October, Sanae Takaichi and the new Japanese cabinet were inaugurated, and market participants then focused on announcements regarding the new Japanese prime minister's stimulus measures.

In her first parliamentary speech, the prime minister emphasized measures related to managing living costs and strengthening defense. In the latter case, the government aims to reach a defense spending level of 2% of GDP sooner, by the end of March (as opposed to the previous target set for the 2027 fiscal year). Takaichi promised an economic growth strategy for next summer, with goals including encouraging public and private investment and increasing tax revenues. The ruling party would support the country's semiconductor and artificial intelligence sectors with ~1 trillion yen (~$6.5 billion) annually (which could represent about 0.2% of GDP). Contrary to the practice of the past few years, this will not be financed from a supplementary budget, but most of the funding will come from the regular budget for the fiscal year beginning in April, according to the plans.

One indication of the shift toward a looser economic policy is that the government plans to abandon the idea of using the annual primary budget balance as Japan's fiscal consolidation target and instead set a new target covering several years. Although the prime minister said this would not happen immediately, the cabinet would begin setting the new fiscal target early next year. In addition, a fiscal stimulus package may be announced soon, aimed at boosting the economy and stimulating growth through investment in key industries.

According to the latest reports, the package could be worth 17.7 trillion yen (~$112 billion). Based on these reports, the total value of the package, including some items already incorporated into the budget, will amount to 21.3 trillion yen. The total stimulus package may correspond to ~3.5% of Japan's GDP (based on 2024 data). The package may include measures to offset the effects of inflation, spending in strategic areas, and strengthening foreign policy and defense; it also includes tax cuts worth 2.7 trillion yen. The package is expected to be financed by increased tax revenues and additional bond issuance, although the amount of the issuance has not yet been finalized. However, a group within the ruling party had previously called for an even larger supplementary budget (Y25 trillion) to finance the upcoming stimulus measures.

Cautious central bank, cautious prime minister

Meanwhile, market participants are also closely watching how Takaichi will relate to the Bank of Japan and its monetary policy. According to the prime minister, if the Bank of Japan tightens policy too early, it could even undermine the government's efforts to boost economic growth. However, according to commentators, pressure from the government on the central bank could cause concern among investors, which could also have an impact on the yen. A weaker yen can be a double-edged sword: it can be favorable for export-oriented companies, but it can also increase import costs, and a possible rise in inflation could be politically risky for Takaichi.

The Japanese central bank has become more cautious in the wake of market turbulence following last year’s summer interest rate hike. According to commentators, the central bankers do not intend to alienate the prime minister, referring to historical experiences when Shinzo Abe threatened to tighten the central bank law in order to force the central bank to loosen its policy more aggressively. However, the economic situation was different at that time: the goal then was to raise inflation from near zero, but now the inflation rate is above the central bank's target level, so an overly loose monetary policy could result in a weaker yen and more persistent inflation. The central bank governor met with the Japanese prime minister again on November 18. According to Kazuo Ueda, the Bank of Japan will gradually withdraw the easing measures provided to the economy, signaling the central bank's intention to raise interest rates further.

The prime minister has repeatedly indicated that she is prepared to implement the spending necessary to stimulate growth, and her previous statements have suggested that she would like to see a cautious approach from the Bank of Japan in gradually raising interest rates. As a result, Japanese government bond yields have crept up again recently, while the yen weakened against the dollar in mid-November to levels not seen since January. The finance minister expressed concern about the recent movements in the yen exchange rate. Following the finance minister's comments, some market participants believed that although intervention by the Japanese authorities in the currency market may be some way off for now, the risk of such a move has increased recently. Japan last intervened in the currency market last summer, when the USDJPY exchange rate was close to 160.

USDJPY technical picture

In the upward trend, the curve has shifted to a steep rise due to the strengthening of the dollar. There is strong resistance around 159.38. It is starting to become heavily overbought, and a downward correction may come soon. As long as the long trend continues, however, no serious decline is to be expected. In the event of a correction, stronger support can only be expected around the 153.13 level.

After a sharp rise, a correction followed on the Japanese stock market

In addition to uncertainty surrounding the size of the government's fiscal stimulus package, diplomatic tensions between Japan and China have also attracted considerable attention in recent days, after the Japanese prime minister said that Japan would be prepared to intervene militarily in the event of a Chinese military operation against Taiwan. In response, China soon advised its citizens to avoid traveling to Japan in the near future. Following China's response, the share prices of several Japanese tourism related companies fell sharply; however, according to preliminary industry estimates, the impact of Chinese tourists potentially staying away as a result of the government warning could reduce Japan's GDP by ~0.36%. According to commentators, if the Japanese prime minister were to withdraw her earlier remarks in response to China's request, she would risk alienating her main supporters, the right-wing conservatives. However, some market players believed that a possible decline in tourist numbers could even alleviate labor shortages and ease inflationary pressures in the service sector.

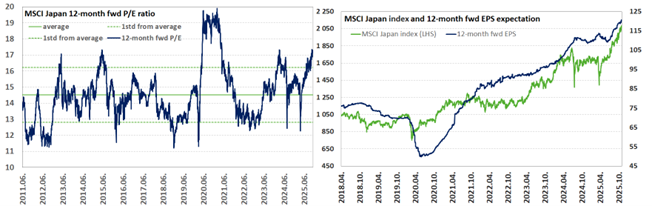

The Japanese stock market rose by nearly 40% between mid-May and early November. The Nikkei turned down from its new high in November, and amid the correction seen in recent days, the index hit a lower high. Although a negative correction was timely after the strong performance of recent months, the Japanese stock market’s valuation is still close to its local high. The MSCI Japan index's 12-month forward P/E ratio is 17.31 (further away from its long-term average of 14.5), which is higher than the valuation of the MSCI Europe index (14.69), but lower than the MSCI ACWI forward P/E ratio (18.89).

In the short term, given the current risk-averse like sentiment in the stock market (and following the significant rise mentioned above), there may still be some room for correction in the Japanese index. Although market participants may well have priced in some of the fiscal stimulus, which could be supportive for the stock market, it appeared for the time being that the government would not deliver any positive surprises regarding the size of the stimulus package. Looking ahead, the Bank of Japan is expected to raise interest rates again at the end of the year (or early next year), and at the same time, the Japanese stock market will need to rely increasingly on profits for further growth. Forward-looking EPS expectations have risen again recently, and Japanese exporters are already benefiting from increased investment in artificial intelligence data centers, factory automation, and energy infrastructure, while the weaker yen may also be supportive for exporting companies. In addition to government measures to help low-income households, and if wage growth outpaces inflation, these could be positive for the sales prospects of domestic companies.

Overall, the Japanese stock market continues to trend upward, but risks also appear to be mounting: in addition to concerns about fiscal stimulus, investors have been watching with concern the planned changes regarding the annual primary budget balance as Japan's fiscal consolidation target and the diplomatic dispute between Japan and China. Market participants were further surprised by the prime minister's comments, in which she criticized companies for focusing too much on shareholders and not paying enough attention to raising wages. Takaichi hinted that she would review the corporate governance code, thereby encouraging companies to distribute resources appropriately not only among shareholders but also among employees. If this happens, we will also review our previously optimistic view of the Japanese stock market, which has become somewhat more expensive in the meantime.

In this regard, it is worth mentioning that at the same time as Takaichi was elected prime minister, a government body discussed revising the corporate governance code, but the parties appeared divided on the focus of possible changes. All in all, a decade of government-backed corporate governance reforms which significantly stimulated the Japanese stock market. As part of this, the Tokyo Stock Exchange launched a campaign two years ago to highlight companies that have taken steps to increase their share prices and put pressure on those that have not. The question is to what extent the prime minister could deviate from her predecessors' shareholder-friendly approach when revising the corporate governance code, but this could be another source of uncertainty for investors, which could cast a shadow over the Japanese stock market in the short term.

Nikkei technical picture

The long upward trend is currently at the 46,875 level. In the zone above 50,000, we saw a double top reversal pattern, which could signal a long closing. The correction phase of the more than six-month rise could determine the expected movement for months. Strong support is only found much lower, around 37,500. If the 46,875 level does not hold, the index could fall back to around 40,625. It is not worth looking for buying opportunities at this time.

Get more out of your investments!

Global Markets Services

OTP Global Markets offers a board range of services in the field of local and international money and capital markets.

Read morePrivate Banking Services

Personal care and expertise with OTP Private Banking, along with the knowledge, security, and innovations of a multinational banking group.

Read more