Investment Outlook 2026

Related content

Micron reports blowout results

On Wednesday, Micron Technology, the leading US memory chip maker, published its quarterly figures, which exceeded analysts' estimates in terms of both revenue and profit. Furthermore, the company gave a execptionally strong forecast for the current quarter, primarily due to insatiable demand for its products, suggesting that memory chips may have become a bottleneck in the AI value chain. This demand dynamic is expected to continue in the near future, which should continue to create favorable conditions for the company to maintain its pricing power and revenue growth trends. We continue to view the fundamentals of this stock, which is also included in our Equity Top Pick List, as strong, and are therefore raising our fair value estimate from $200 to $325.

Commodities - Technical Analysis

Gold’s rally is approaching its previous peak, and so far there are no signs of a reversal. However, return potential has deteriorated significantly, which means corrections could also be larger. Silver has been setting new highs for some time with strong momentum, but it too may be nearing a major top. Oil has hit a new swing low, maintaining the downward trend. Natural gas, after reaching the expected target level, dropped sharply and is now at a support zone, which could present a buying opportunity. Copper’s advance has stalled but has not yet broken down; it needs to resume its upward move within days, otherwise a strong pullback may follow. Wheat has broken below the support at 531, targeting the 500 area next. Corn remains above its trendline and needs to move higher soon, or else a sharp correction could occur there as well.

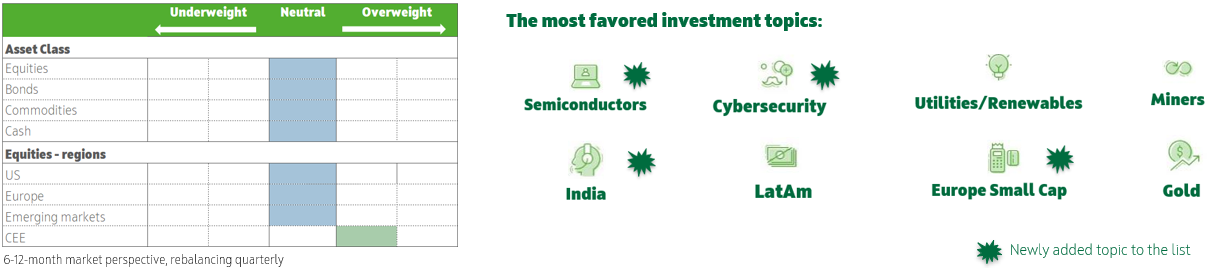

Consumption and AI related investments saved the year in the US with 2% GDP growth, and despite the trade war and shutdown the outlook remained solid. Fiscal and monetary easing continues to provide strong tailwinds, but equities are expensive, meaning there is less and less room for error. We are therefore keep some powder dry, to increase equity exposure in case of drawdowns, and selectively choosing between sectors and regions for excess returns. Within Europe, we see potential in the cheapest small-cap segment, several factors could catalyze its outperformance in addition to the German stimulus.

Macro

Consumption and AI related investments saved the year in the US with 2% GDP growth, and despite the trade war and shutdown the outlook remained solid. Recession risk is low, but the weakening labor market, high and fast rising debt, halted disinflation above CB’s target, and political pressure on the Fed remain a cause for concern. Looser fiscal policy in the EU could add to GDP growth in 2026-2027, but debt sustainability issues can not be neglected. Inflation is at target levels, but risks are more tilted to the upside. In the short run we expect the market to price in more cuts as the new FED chair is getting closer, which will moderate long bond yields. In Europe, we still expect term premiums to rise. From the current level, we do not expect further meaningful HUF appreciation, but holding long positions remains to be attractive due to high interest rate differential.

Equities

Fiscal and monetary easing continues to provide strong tailwinds, but equities are expensive, meaning there is less and less room for error. We are therefore keep some powder dry, to increase equity exposure in case of drawdowns, and selectively choosing between sectors and regions for excess returns. In the US, we favor sectors primarily linked to the development of AI infrastructure, like semis on the hardware and cybersecurity on the software, utilities/renewables on the energy supply side. Within Europe, we see potential in the cheapest small-cap segment, several factors could catalyze its outperformance in addition to the German stimulus. The weakening dollar and Fed interest rate cuts are tailwinds for EM, but valuation is already neutral, so we prefer the cheapest Brazil and the nearshoring driven Mexico. After a long consolidation, we would also start building positions in the structural megatrends driven India. We see no change in the factors driving CEE so far, depressed valuations compensate for higher risks.

Bonds

While the weakening labor market and slowing growth are pushing yields lower, continued significant budget deficits and deteriorating debt trajectories pose risks in the opposite direction. For this reason, we continue to favor the short/medium end of the yield curve. Corporate bonds’ historically tight spreads do not cover the increasing risks.

Commodities

We maintain an overall neutral view on commodities, as energy and agricultural products remain weak for now. However, the outlook for industrial and precious metals remains favorable, so selective exposure is recommended. We like copper, uranium, and gold related exposures.

Get more out of your investments!

Global Markets Services

OTP Global Markets offers a board range of services in the field of local and international money and capital markets.

Read morePrivate Banking Services

Personal care and expertise with OTP Private Banking, along with the knowledge, security, and innovations of a multinational banking group.

Read more