OTP Morning Brief: Europe’s stock markets opened 2026 with new highs

Related content

OTP Morning Brief: The Fed did not cause surprise

The Fed did not cause surprise; Meta’s and Tesla’s earnings reports were well received, but that of Microsoft disappointed. Western Europe’s stock markets fell, led by luxury companies, while CEE markets closed at new highs. In Hungary, Richter and OTP headed the rally, the latter ended at a new high. The Fed’s decision did not move US markets, investors waited for big tech companies' earnings reports to be published. The EUR/USD turned back from its 1.2 peak, while the EUR/HUF remained around 380. Bond yield moved mixed, Hungary’s long-term yields sank. Precious metal prices hit new highs again. Today, the USA releases factory orders and weekly unemployment statistics, and Hungary publishes industrial producer prices and detailed foreign trade statistics. As the earnings season continues, Apple, Mastercard, and SAP release their reports today.

OTP Morning Brief: Fed rate decision may drive markets

The EU and India struck landmark trade deal. Most stock markets in Western Europe rose on Tuesday. CEE stock markets also climbed higher; all Hungarian blue chips rose. US indices increased, except the Dow. Brent and WTI prices grew. The dollar’s continued weakening pushed the EUR/USD to 1.2. Gold prices reached a new high, the price is nearing 5,200 USD/oz. The MNB’s Monetary Council left its base rate at 6.5%, as expected. Investors await the Fed's interest rate decision today. The earnings season continues with reports from heavyweights such as Microsoft, Meta, Tesla, and IBM.

Europe’s stock markets opened 2026 with new highs, but Hungary’s stock exchange was closed. US stock markets started mixed, oil prices declined further. The US attacked Venezuela, and captured President Maduro and his wife, Donald Trump announced. The year started with a rise in international bond yields; the dollar and the forint strengthened against the euro. According to macro data released before the holidays, the US economy grew stronger than expected; Hungary’s current account surplus grew in 2025Q3. EZ inflation and US labour market data are in focus this week

Europe’s stock markets started 2026 at new highs; Hungary’s stock exchange was closed

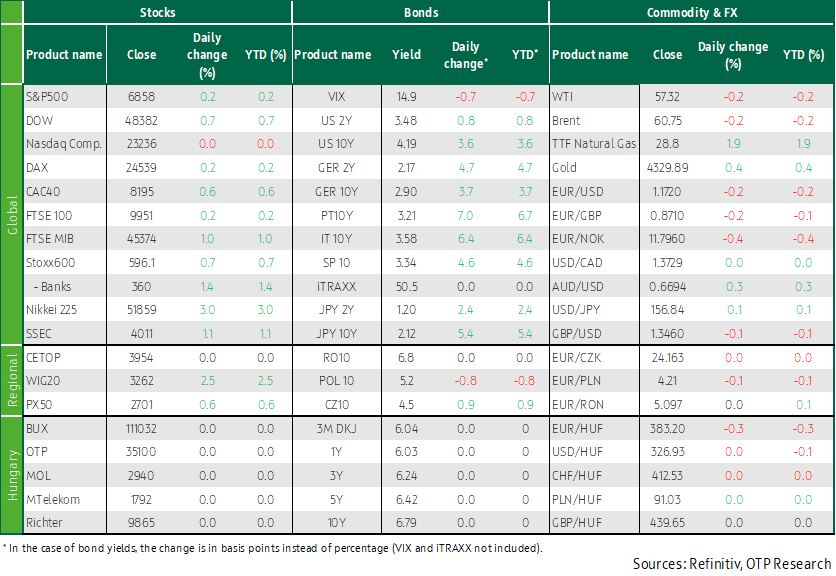

Having closed the last trading days of 2025 at new record levels, Western Europe’s stock markets opened 2026 at new historical highs. London's FTSE 100 briefly hit the psychological level of 10,000 points for the first time on Friday. The STOXX 600 (+0.7%) set another record, continuing the third consecutive week of gains. The STOXX index closed 2025 with its best performance (+17%) since 2021, thanks to falling interest rates, Germany's fiscal stimulus and investors rebalancing their portfolios from overpriced US technology stocks towards the end of the year. Germany’s DAX (+0.2%), France’s CAC40 (+0.6%) and the FTSE100 (+0.2%) all gained on Friday. ASML (+7%) supported the STOXX 600 index, as well as its peers and the technology subsector.

Defence stocks were the best performers, surging 3.3%. Basic materials rose by 0.6%, while the energy index increased by 1.4%, tracking gains in precious metals and crude oil.

Precious metals kept up last year’s rally, with gold up 0.4% to 4,330 USD/ounce and silver soared 1.9%, to USD 72.62. In 2025, gold price made the largest gain in 46 years (64%), while silver (147%) achieved a historic record in annual terms; Fed rate cuts, geopolitical tensions, central banks’ robust purchases, and ETF inflows all drove the uptrend.

The Budapest Stock Exchange was closed on Friday. Elsewhere in the CEE region, stock markets (WIG20, PX50) also rose to new highs in the benign sentiment. Before the holidays, the BUX and OTP also closed at all-time highs.

US stock markets started the year mixed; oil prices continued to decline

America’s stock markets closed mixed on the first trading day of the year. The three leading US stock indices showed significant fluctuations on Friday, but the S&P 500 and the Dow finally closed higher, snapping their four-day losing streaks, while the tech-heavy Nasdaq ended slightly lower, mainly due to the weakness of tech giants. All three indexes posted losses in the holiday-shortened week. The Nasdaq closed 2025 with a whopping 89% gain thanks to the AI ??rally, while the S&P and Dow added 16% and 13%, respectively.

According to the data released on 23 December, the USA’s GDP grew by 4.3% YoY in Q3, surpassing expectations of 3.3%, mainly due to stronger-than-forecast consumption growth (3.5% after the previous 2.5%). At the same time, investment dynamics have slowed from 4.4% to 1%. Final sales to domestic private consumers, the most important indicator of economic activity, maintained robust growth (+3%), after 2.9% in Q2. However, the market expects GDP growth to slow significantly in Q4, to around 2%, due to the government shutdown.

Oil prices descended on Friday. In 2025, they recorded their biggest annual loss (-20%) since 2020. Investors weighed fears of oversupply against geopolitical risks, including the war in Ukraine and the situation in Venezuela. Brent crude futures sank 10 cents, to 60.75 USD/barrel, and so did WTI, to USD 57.32.

On Wednesday, the Trump administration increased pressure on Venezuelan President Nicolás Maduro, imposing sanctions on four companies and their oil tankers that were allegedly active in Venezuela’s oil sector. In a New Year’s interview, he said his country was ready to welcome American investment in the oil industry, cooperate in the fight against drug trafficking, and engage in serious negotiations with the USA. However, on Saturday, the United States invaded Venezuela and removed the long-ruling autocratic president, Donald Trump announced. It was Washington’s most direct intervention in Latin America since the 1989 invasion of Panama. Maduro and his wife were captured by US special forces. Maduro is facing criminal charges in the USA. He was indicted in US federal court in 2020 on charges of narco-terrorism and other crimes, he allegedly controlled a scheme that transported tons of cocaine into the USA through the so-called “Cartel de Los Soles,” a charge he has always denied.

Year 2026 started with an increase in international bond yields; the USD and the HUF strengthened against the EUR

After Christmas, yields declined due to lower-than-expected inflation and weaker labour market data; but this reversed in developed economies’ bond markets on the last two trading days of 2025 and the first trading day of 2026: over these three days, short-term yields upped by 3-5 basis points, and long yields by almost 10 basis points. One reason for the increase was that investors' attention turned to the expected high bond supply this year due to significant budget deficits. In addition, the number of new unemployment claims in the USA fell sharply at the end of December. Investors expect the Fed to make two more 25-basis-point cuts in the first half of 2026, after a short break; that could bring the base rate sustainably to 3%, which is considered to be the longer-term equilibrium level. The ECB is expected to leave its key interest rate at 2% this year, but interest rates may rise in early 2027. The rise in recent days brought 10Y yields back to the peaks seen before Christmas; the US yield was close to 4.2% and the German yield near 2.9%. Thus the US 10Y bond yield is hovering in the lower quarter of its post-Covid trading range, after a drop of about 40 basis points in 2025. Having increased by nearly 50 basis points in 2025 as Germany’s budget spending plans and European interest rate hike expectations strengthened, Germany’s 10Y bond yield is nearing the upper edge of its trading range.

The EUR/USD rose to a four-year high of 1.18 after Christmas, and then it returned to 1.172 by the end of the first trading day of 2026. The dollar lost almost 15% last year, after the new US administration revealed its defence and reindustrialization goals, through tariff war, persistently high budget deficit, lower interest rates, and low oil prices.

In Hungary, the forint appreciated against the euro at the end of the year and returned to 383 after a temporary weakening in early December (to near-390 levels), which was partly caused by the fact that the MNB, after arguing for the need for a permanent tightness and a strong exchange rate, cautiously opened the door to an interest rate cut in early 2026. Thanks to the strictness of the new central bank governor, Mihály Varga, the Hungarian currency closed 2025 with a roughly 7% strengthening, marking a bright spot after the continuous depreciation in previous years. Hungarian bond yields barely moved at the end of 2025 (and there was no trading this year); discount T-Bills’ yields were around 6%, and those on 3Y-5Y maturities were 6.25%-6.4%, 10Y yields were 6.8%, and longer ones were around 7.3%. Looking at 2025 as a whole, intra-year yields increased due to the MNB's tightness, but longer yields barely changed compared to the levels at the end of 2024.

Regarding Hungary’s macro data, it is worth highlighting that according to statistics released on 23 December, in 2025Q3, the current account surplus amounted to EUR 932 million, which was EUR 556 million higher than the level a year earlier. The four-quarter balance showed a surplus of 1.8% of GDP, which is consistent with 0.2-percentage-point growth compared to the previous quarter. The increase in the current account balance for the four quarters came from a higher surplus in Hungary’s foreign trade balance. The gross external debt stood at 64.1% of GDP, similarly to the level seen at the end of the previous quarter.

The HUF weakened by 0.5% on Monday, reversing Friday’s strengthening: the EUR/HUF closed at 388.71. While yields rose elsewhere, Hungary’s benchmark yields sank on securities maturing in up to ten years, yields on 15Y-20Y tenors increased; the 10-year yield was 6.78%.

Today’s highlights

Asia’s indices were seen rising this morning as investors digested the situation in Venezuela. China’s stock market grew by more than 1%, Japan’s Nikkei was up by 3(!)%. European and American index futures were also rising, while WTI dropped about 0.5%.

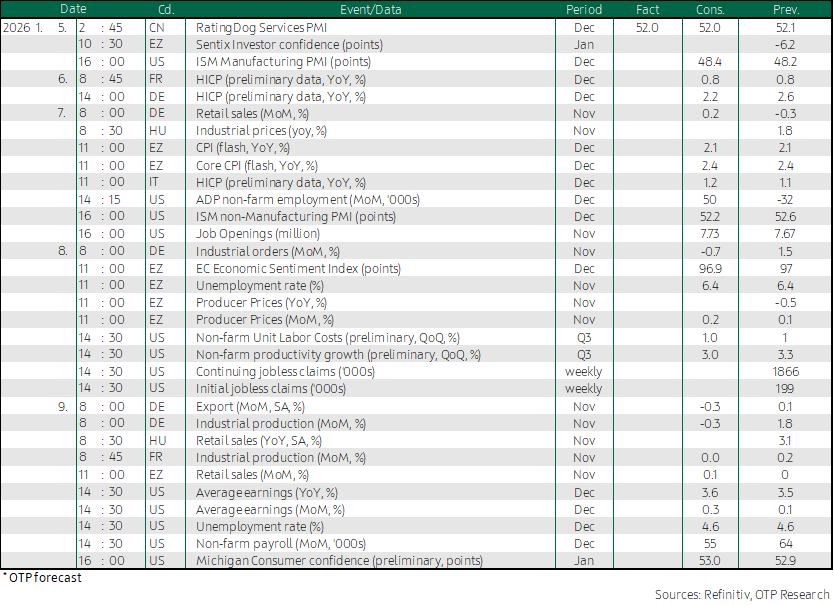

Later this week, the eurozone's December inflation data and the US labour market statistics will be released. In Hungary, retail sales statistics will be published on Friday. As for the former, the big question is the development of core inflation and services inflation, which were 2.4% and 3.5% in November, causing the ECB headaches. Two ECB decision-makers called that an unpleasant surprise, and it was also said that the ECB's next interest rate move may be an increase, rather than a cut, but not anytime soon. In the long term, the market priced in two interest rate increases by the end of 2027.

As for December’s US labour market data, initial jobless claims increased by 64,000 in November (by a total of 610,000 by November 2025). This is better than expected, and suggests that private sector employment has already reached its bottom. The unemployment rate, meanwhile, rose further to 4.6%, which is less worrisome when we take into account the rounding effect, as the rate actually rose from 4.44% in September to 4.56% in November, and the fact that the labour force has increased over the past four months despite strict immigration policies. The uptick in average hourly earnings was unusually weak in November, at 0.1%, down from 0.4% in October, but the annual growth rate was still strong at 3.5%.

Get more out of your investments!

Global Markets Services

OTP Global Markets offers a broad range of services in the field of local and international money and capital markets.

Read morePrivate Banking Services

Personal care and expertise with OTP Private Banking, along with the knowledge, security, and innovations of a multinational banking group.

Read more